Smart Bookkeeping for Architects: 5 Tips to Get Paid Faster

24/11/2021

Email Marketing

Email Marketing

Professional staff also need to attend conferences, seminars, webinars, and training courses for individual or firm-wide continuing education needs. Last but not least, there is the https://www.bookstime.com/articles/part-time-accounting undesirable “I-do-not-have-a-project-to-work-on” time that all staff and firms seek to avoid. Finally, there is the time spent by management staff on administrative and organizational tasks and responsibilities related to managing a firm.

How Can Fincent Make Bookkeeping Easy For Small Architecture Firms?

He works with A/E Principals and Boards on operations & financial analysis & systems, strategic planning, turnarounds, and interim assignments. He has been Chair of AIA Chicago’s Practice Management Committee, an AIA/ACEC Peer Reviewer, and on ACEC’s Management Practices Committee. Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team.

Bookkeeping Basics for Small Firm Architects

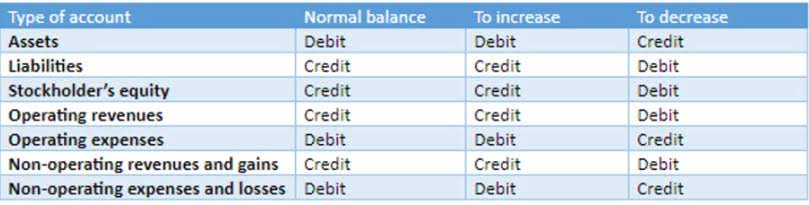

While many companies can manage their books and records, others will need an accountant to assist. Understanding these unique elements will help you build a solid financial foundation for your architectural firm. Note again the emphasis on net rather than total revenue, the use of which provides comparability at group, department, division, etc., levels, as well as the overall firm. “Metric” is a rather generic term, and a metric can be derived for almost anything measurable or quantifiable. Financial metrics, so-called because the metrics are derived from financial statements, are a principal means of monitoring operational activities. Yet just because something can be measured does not mean that it needs to be monitored.

Just upload your starting project budget, and follow the financial progress in real-time

As architects, your focus should be on drafting efficient designs, not drowning in financial paperwork. At Bench, we understand your unique needs, and speak the complex language of architecture business taxes, laws, and bookkeeping. We know that you work on a project-to-project basis, so you deal with intricate invoices, overhead expenses and payments that vary greatly, making financial management a herculean task. We’re also familiar with the industry-specific taxes such as the federal historic preservation tax incentives for rehabilitating historic structures, or deductions available for energy efficient commercial buildings. Bench revolutionizes this process by pairing intuitive software with real, human bookkeepers. Our expert team understands the nuanced financial aspects of the architectural industry.

That means that $114,667 of the $130,000 is gone the same day it came in. Depositing the check and paying all these bills is the difference between the balance sheets at 12 pm and at 5 pm. All that remains is about $2,833, leaving a total of about $7,833 in cash for paying firm expenses between now and when the next client payment of $130,000 is received at the end of April. Accounting is a vital part of any business, but it comes with a unique set of challenges for architectural firms.

Further, higher indirect labor itself causes overhead to increase (a simultaneous increase in the numerator of the overhead rate equation). As such, the first place to look for any explanation for variances in the overhead rate is to look for changes in utilization rate. Construction bookkeeping is critical for tracking finances, maintaining project profitability, bookkeeping for architects and making informed decisions. By implementing effective bookkeeping practices, construction companies can gain better control over their budgets and ensure projects contribute positively to their bottom line. Financial reports, such as profit and loss statements and job costing summaries, provide insights into project health.

- We team up with major vendors such as Gusto, Stripe, Shopify, and Square—providing your architectural firm with consistently accurate financial records.

- Therefore, you must have your basics in place to effectively foolproof bookkeeping and accounting for small architecture firms.

- Create a system enabling you to obtain the financial clarity you need to be profitable in as little time as possible.

- As a result, PlanMan offers a streamlined and integrated approach to accounting that’s weaved into the typical routines of freelance architects.

- However, rather than “everything else,” indirect expenses are more easily explainable and understandable if the category is viewed as having two components, one of which is quasi-labor related.

- Another key aspect of bookkeeping is calculating your monthly net income or loss.

Outsourced Architecture Bookkeeping, Accounting, and CFO Services

At the same time, this may seem like just another item on your to-do list, but preparing your financial statements can help your bookkeeping for the following year. When it comes income summary to billing clients and managing expenses, accuracy is key. Fortunately, several bookkeeping software programs are designed specifically for small businesses. These programs can make it easy to track your income and expenses and even help you calculate your net income or loss for the year.

loading...

loading...

Lascia un commento

Devi essere connesso per inviare un commento.